As a business proprietor, you understand the significance of maintaining accurate income and expense documents. Your business would perish in that case. However, it can be difficult to keep up with everything due to the complexity of tax laws and requirements. Tax planning software can make your life easier and save you money! With tax planning software, you can save time, keep accurate records, reduce errors, and complete your taxes quickly.

For small business proprietors who prefer to concentrate on the success of their company rather than bookkeeping, these things are essential. This article examines the best tax planning software for small and medium-sized businesses. You will learn what each one offers, how it works, and what to consider when searching for the ideal tax planning software. This article will help you find a company that will work well for your requirements and budget if you’re looking for a new tax planning software plan for your small to medium business.

What’s Tax Planning?

Tax planning is the continuous process of formulating business strategies, focusing on tax-related aspects. It may involve constructing a budget, establishing a business structure, and determining how to capture revenue in the best possible way. Many SMBs and SMEs need help determining how to pay taxes on their profits. This is where tax software is useful. Using the software to file your taxes is now easier than ever due to the constant evolution of technology. Tax preparation software enables you to take care of all required filings, so you no longer have to worry about them! By automating a bunch of the work for you, tax software can help reduce your mental burden. You can also use these programs to determine what deductions are open for your business and where you meet government regulations.

Why Do You Require Tax Planning Software?

Tax planning software is essential for small business owners. It allows you to prepare your taxes swiftly and efficiently, making receiving the tax refunds you deserve easier. As a small to medium-sized business proprietor, you understand the importance of accurate record-keeping to your company’s success. Tax preparation software helps you keep track of all your expenses, which is essential for accurate tax reporting. In addition, it allows you to plan out the amount of tax due, the deductions that can be claimed, and more. It’s one of the best methods to save money while expeditiously preparing your taxes! You will also have access to all of this software’s tools that will help you save time and money on your taxes.

Using Tax Software Benefits

Tax preparation software can save you time, reduce errors, and help you keep accurate records. It also makes it simple to manage your finances!

Tax Planning

If you are not a tax expert, figuring out how much you will owe in taxes for the upcoming year can take time and effort. If you want to spend less time filling out paperwork, investigate. With useful tax planning software, you won’t have to worry regarding this anymore, as these programs can help you find the best way to file your taxes. Moreover, many programs will calculate how much you will save using them effectively!

Streamlined Bookkeeping

Bookkeeping is a task that needs to be more frequently addressed due to its perceived complexity. However, tax software makes this task easier because all necessary financial data is stored in one place. This makes it easy for anyone who manages this task to make changes without seeking scattered documents throughout the office.

Accuracy

Using tax preparation software saves time and reduces errors.

Regardless of the scale of your business, tax planning software will meet your requirements. Here are nine tax planning software programs that are currently available for use.

Top Tax Planning Software

As we curated, the best Tax Planning Software are listed below.

1. TaxWise

TaxWise provides tax professionals with the most sophisticated tax software to help them increase tax productivity, revenue, and efficiency, allowing them to concentrate on their clients and grow their businesses. Assume that you are preparing your own 1040 tax returns or corporate tax returns or that you are a novice Tax Payer, a seasoned Tax Payer, or a Service Bureau. With the help of Virtual Tax Office, TaxWise provides the resources and tools to help you prepare and file additional U.S. tax returns in less time – anytime, anywhere. In addition, TaxWise offers a variety of payment options for fees that vary from traditional refund transfer services (bank products) to low-cost alternatives that enable you to collect fees at no cost to your taxpayer. Use TaxWise immediately to make your business more efficient.

TaxWise Online – Facilitates the Virtual Tax Office. To help support your ability to safely operate a cloud-based tax preparation company, it has been upgraded with its Vault Document Storage, eSignature, Client Portal, and TaxWise Mobile. It allows you to access your tax returns and office documents anywhere.

Time-Saving Features – Use these time-saving software tools to file more tax returns. Live monitoring of refunds, easy coloring, and analysis via hyperlinks that verify any errors in e-filing before you file line-by-line tax errors and tax form defaults reduce tax preparation time by 20%!

TaxWise Mobile – It gives your customers an easy and secure way to start their tax returns from the comfort of their phone, computer, or tablet. The taxpayer uses TaxWise Mobile to upload tax documents and fill out the essential information for their return, which is then directly incorporated into TaxWise Online, saving you time.

TaxWise Desktop – Installed locally on your office computer and network. The essential TaxWise Desktop software stores your tax return information on your computer and gives you access to individual 1040, 1065, 1120, 1120S 10, 41 706, 706, 709, and business 990 tax returns.

Refund Transfers – TaxWise offers a wide range of payment methods allowing customers to deduct tax preparation costs from their tax refunds. These payment methods range from traditional refund transfer services (bank products) to low-cost alternatives that are free for your taxpayer.

Bilingual Spanish Features – Use more than sixty tax forms and schedules that are available in Spanish. Supporting bilingual products ensures that your staff always has access to the necessary assistance.

2. Tax Planner Pro

Tax Planner Pro has an intuitive interface, easy-to-follow instructions, and expert guidance for every tax-saving strategy. As a result, it is one of the best apps created for small businesses.

Small Business Tax Planning – After connecting your financial information to Tax Planner Pro, IVAN’s tax strategy engine will evaluate your financial situation and create a customized tax strategy for your company and you. They will demonstrate how to reduce your tax burden to $1.00. We will reduce your tax liability, whether it takes five plans, thirty plans, or more!

Multiple-Business Projections & Planning – If you own multiple businesses, you can use the “Hydra” feature, which allows you to integrate up to eight QuickBooks Online or Xero businesses into a single taxpayer. You can mix and match various business bookshelf platforms, business types, and more with Hydra. The projections and return figures reflect the performance of all businesses.

Sync Bookkeeping – Stay current by synchronizing your financial sheets and other integrations automatically. In less than a minute, the configuration procedure is simple and easy.

Proactive Updates & Advice – You can update your tax projections and options weekly to ensure you are always up-to-date with the most recent information. The QuickBooks Online sync will notify you when new information is available and provide options for planning your work.

Upload Tax Returns – Tax Planner Pro can read your tax returns and perform complete data entry on your behalf to fully automate tax planning.

3. Income Tax Planner

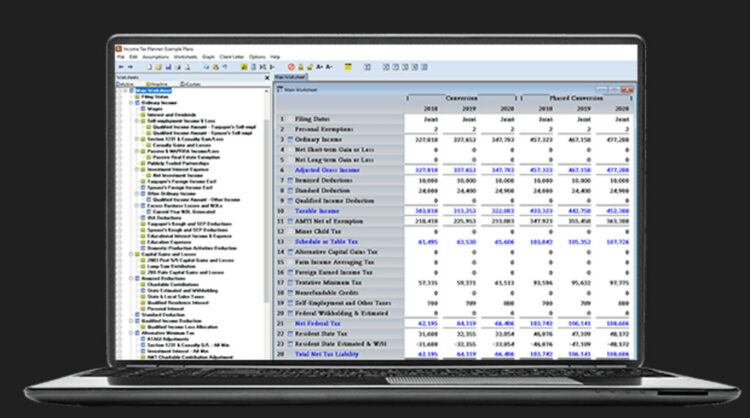

Bloomberg’s income tax planner enables you to rapidly address complex tax planning issues to reduce federal tax liabilities and deliver the most efficient strategies to your clients while sticking to the most recent federal and state tax laws.

Maximize Return – Estimate tax-free capital gains, capital gains, and taxes for resident and non-resident states to maximize return. With Income Tax Planning, you can prepare for tax ramifications throughout the year from marriages, Roth conversions, stock transactions, and other events.

Expertise You Can Trust – Provide clients with accurate and efficient information about their tax situation by analyzing and comparing two scenarios. Create precise, expert, and efficient tax plans that assist your clients in lowering their tax burdens and making well-informed decisions. Make it easy to comprehend and navigate complex tax-related scenarios. Use Bloomberg Tax & Accounting’s expertise in taxation with up-to-date calculations, detailed analyses, projections, and much more to determine the most efficient tax, investment, or retirement plan option for your clients.

Plan Fast – Boost your productivity by implementing the proper income tax planning strategy. Income Tax Planner’s time-saving algorithms, software, and automated calculations and analysis do the heavy labor. First, specify the variables you wish to model, such as capital gains, estate tax, farm income retirement, and phaseouts. Then, on behalf of your clients, you will receive instant results and insight into the most tax-efficient option.

Results – Develop plans with your clients. Making income tax calculations and presenting your plan with the effects of different scenarios is easy if you are a CPA, financial planner, or wealth management expert because you can compare two views and give an insightful presentation.

Training & Support – Unrestricted technical support can help you succeed and maximize this tax-saving tool. The crew consists of on-site experts from Bloomberg Tax & Accounting (many attorneys and CPAs). As a result, you gain expert knowledge of the program and comprehension of the accounting and tax issues you face in the real world.

4. Holistiplan

Holistiplan enhances tax planning, making tax consulting more comprehensive and efficient. For example, Holistiplan can read a tax return and produce a customized, white-labeled tax return with pertinent observations in mere minutes with the help of cutting-edge OCR technologies.

Generate Client Deliverable – Holistiplan generates a tidy and easy-to-read client document with your company logo at the top and a disclaimer at the bottom. It can be stored as a PDF, emailed, or printed for in-person client review and discussion.

Instant Scenario Analysis – The same OCR technology can also fill in an analysis screen that enables advisors to instantaneously identify the most significant income breakpoints that can be easily used for tax planning options.

5. Bonsai

Bonsai is designed to help independent contractors save the most money possible on taxes. This tax tool integrates purchases made with linked credit cards and classifies them appropriately. The best feature of the Bonsai Tax is that it automatically identifies deductions you might otherwise overlook, resulting in an overpayment of taxes. In addition, you receive quarterly tax estimates to estimate your total tax liability. In addition to tax, you also receive an excellent invoicing tool and reviewed contracts for business use. Bonsai Tax is an international tax calculation utility that supports 180 global currencies. You can suspend your subscription for up to three months and resume it when things pick up. In addition, you can terminate your subscription at any time and continue to have unlimited access to your documents and free Bonsai features. There is a two-week free trial to try it and see if it works for you.

6. ProSeries Tax

With ProSeries Tax, you can create a connected virtual tax office outfitted with robust tax software and integrated taxpayer solutions, which will help you concentrate on delivering the best financial results to your customers. Formulas for tax-related data entry – Choose from over 3,700 forms and use ProSeries forms-based input for data, which provides a simple display that is straightforward to explain to customers.

Advanced Diagnostics – Reduce rejections and increase your clients’ reimbursements with over a thousand diagnostics that will assist you in evaluating and optimizing each tax return. You can breathe easy knowing that the ProSeries tax software will automatically detect data mistakes and errors.

Access Online – You can access it on workstations from anywhere. It is a cloud-based app with advantages like quick updates, automated backups, multiple security layers, and access for multiple users.

Financial Institution Download – Download the 1099, and W-2 forms directly from your financial institution. In addition, you can access more than 275 supported partners through the ProSeries software for free.

7. Drake Tax

Drake Tax has features that will help you process and prepare your clients’ tax returns promptly and efficiently. In addition, it means you’ll be able to focus on the things that matter most, such as interacting with customers and expanding your business.

Speed You Require – Drake Tax will help you complete tasks more quickly and expedite the process of preparing your tax return. However, a few keystrokes are required to obtain calculation results and complete return information.

Drake Tax Planner – Inform clients how their marital status, dependents, income, and other factors can affect their tax returns. You may save multiple scenarios and modify reporting options as necessary. Calculation results display return information concisely, including errors and notes, fees, refund amount, and eligibility for e-file files. In addition, customers who wish to approve their tax return, consent form, and other bank documents are provided with PIN and Consent screens.

Drake E-Sign – Use an additional signature page to combine customers’ signatures with their returns safely. This eliminates the need for a physical copy. Data flow from federal returns to city and state returns is automated, with override options. As required, state and city returns are produced. Drake Tax fills in automatically based on ZIP Code and EIN entries. Credit taxes imposed by other authorities are remitted automatically.

8. Thomson Reuters

Using the time-saving and efficient tools from Thomson Reuters UltraTax Professional Tax Software, you can automate your business’s whole tax management process. You will access a comprehensive range of state, federal, and local tax-related programs, including 1040 personal, 1120 corporate, 1065 partnership, 1041 trusts and estates, and multi-state returns. In addition, the seamless integration of UltraTax CS with other Thomson Reuters solutions, such as CS Professional Suite and Onvio cloud software, eliminates the need for hours of manual processes. Implementing end-to-end, customized software based on cloud computing, advanced data sharing, and paperless processing will allow you to satisfy all of your tax workflow requirements.

Multiple Monitor Flexibility – You can view input, forms, previous year’s input, diagnostics, and more on as many as four monitors simultaneously.

Instant Prep Checklist – Begin each year with a list that instantaneously retrieves the client information from the previous year’s tax return.

Easy Data Sharing – No need to manually link the 1120S, 1065, or 1041 tax returns to the 1040 tax return. Advanced capabilities for e-files use e-file software to track each phase of the submission process to ensure the returns are accurate and complete.

Multi-state Processing – To calculate business returns, read the Schedule C and K-1 tax returns across states using the Multi-State Allocation grid and the Apportionment grid.

UltraTax CS-Electronic Signature – This function lets you collect electronic signatures for tax documents from any place.

9. TaxPlanIQ

TaxPlanIQ is an app designed for tax professionals to manage initiatives. It is an easy-to-use tax planning system designed to improve your business and enable you to regain control of your company. Your clients need more than a simple number cruncher. They require a financially dependable companion. TaxPlanIQ simplifies your life and demonstrates the tremendous value you offer. Get started with your trial immediately. You have fourteen days to familiarize yourself with TaxPlanIQ and observe its results. There will be an immediate increase in the investment’s value. They will walk you through your initial tax plan to familiarize you with the return on investment. TaxPlanIQ will transform your accountancy company. This platform is designed to increase the value of your business and give you back control over your company.

- Reduce the possibility of making errors and increase your confidence in your work for clients.

- Reduce the intricacy of your business while receiving support from best practices that result in a tremendous ROI and a business boost.

- Knowing you have a support system and a team of tax professionals on your side, you should be confident to tackle the tax burden.

- TaxPlanIQ provides the information you need swiftly and accurately, allowing you to gain distinct insights in real-time.

- Provide your customers with improved options that can save them time or money. They may also permit you to add a surcharge.

Use tax strategies that simplify work, have been approved by attorneys, and help improve lifestyle balance to save time.

10. Corvee

Cloud-based tax planning, client collaboration, and payment software deliver the most value to your customers and clients. Corvee Tax Planning software for accountants automatically analyzes and identifies the most vital information from tax returns to help you save time. If you include queries and tax returns, you will have 99 percent of the information necessary to develop an effective tax plan that will make your clients’ money more efficient each year. You can complete all of these tasks using the software from Corvee Tax Planning within minutes.

Corvee Client Collaboration allows you to send and digitally sign engagement letters, Internet-based customized templates, questionnaires, passwords, and files. Within their software for accounting firms, you can schedule SMS and email reminders to facilitate client communication. First, ensure your client understands what is expected of them by sending them a secure message with clear demands. Then, notify them once their file has been approved.

Consider The Following:

The Bottom Line:

Your business is a dynamic entity. It requires continual care and nourishment to flourish. For small business proprietors, tax season can be among the most contentious times of the year. This article has been compiled to make your experience with tax planning software as easy as feasible. Software for tax planning can help small and medium-sized businesses manage their tax obligations and minimize tax liability. In addition, with the proper tax software, you can keep records organized all year and file documents in one place.