You may be able to earn passive income with the Bitcoins you have sitting around in your wallet. Let’s examine a few of the top websites for lending bitcoins and other Cryptocurrency Lendings.

People are frantic about trying to make money in the cryptocurrency industry, as it is currently the largest term in the market.

Many people believe that cryptocurrency is just like stocks and nothing more. However, there is actually a tonne of information regarding blockchain technology and cryptocurrencies.

Purchasing cryptocurrency and storing it until the asset’s price increases is one of the most popular methods of investing in cryptocurrencies. Is it the only method to profit from the cryptocurrency market, though? The response, then, is no. If you look more closely, you’ll find that many people are discussing cryptocurrency lending and making interest. Indeed, you can earn substantial interest rates on the money you put in various cryptocurrencies!

That seems like a great offer, don’t you think?

The sole distinction is that an investor uses a platform to lend cryptocurrency rather than fiat money, but the lending principle is still the same as it is in traditional lending. Borrowers use cryptocurrency lending obtained from various sites for trading or other purposes. In exchange for the money they lend to borrowers on any decentralized network, investors receive cryptocurrency dividends.

To have a thorough understanding of the concept, read the article on Cryptocurrency Lending and borrowing.

We will now examine the elements to take into account while selecting a cryptocurrency lending platform.

How Do I Pick a Cryptocurrency Lending Platforms?

You must take into account a number of criteria while choosing a lending platform. Among the crucial elements to think about are:

- Interest rates: Select a platform according to the coin’s interest rate on each individual platform.

- Platform risks: To gain a better understanding, review the platform’s history.

- Fees: Examine the prices charged by various sites for various coins.

- Deposit cap: Verify whether or not a minimum deposit amount is required.

- Lending duration: Check to see if the Lending Duration is Fixed.

- Collateral: Examine the requirements of various platforms for the quantity of collateral required to obtain a particular lending amount.

The most crucial thing to remember is that every coin has a proper platform that you should choose. For example, you ought to think about using Binance for bitcoins if you see that it offers higher returns for lending bitcoin.

It’s not necessary to lend every cryptocurrency on the same site. To determine where you may receive higher profits for the cryptocurrency you have selected, you need to investigate alternative platforms.

However, in order to choose the best place to obtain a cryptocurrency lending with the lowest interest rate for their cryptocurrency asset, borrowers need to evaluate several platforms.

Let’s now examine a few of the top cryptocurrency lending platforms.

1) AAVE

A well-known decentralized liquidity protocol is AAVE. It is a non-custodial system that allows you to stake your assets to borrow money and earn interest on your cryptocurrency deposits. AAVE is a sophisticated liquidity protocol that offers many more functions than just the ability to lend and borrow cryptocurrency assets.

Average users can deposit or borrow assets on the site, as you’ll see as you move around. To make it easier for you to compare deposit and lending rates across different platforms, interest rates have also been simplified.

The AAVE protocol includes several concepts, such as flash lending and bug bounties. It’s interesting to note that the development community will give you up to $250,000 in USDC tokens if you report a bug. Thus, it is definitely worth watching!

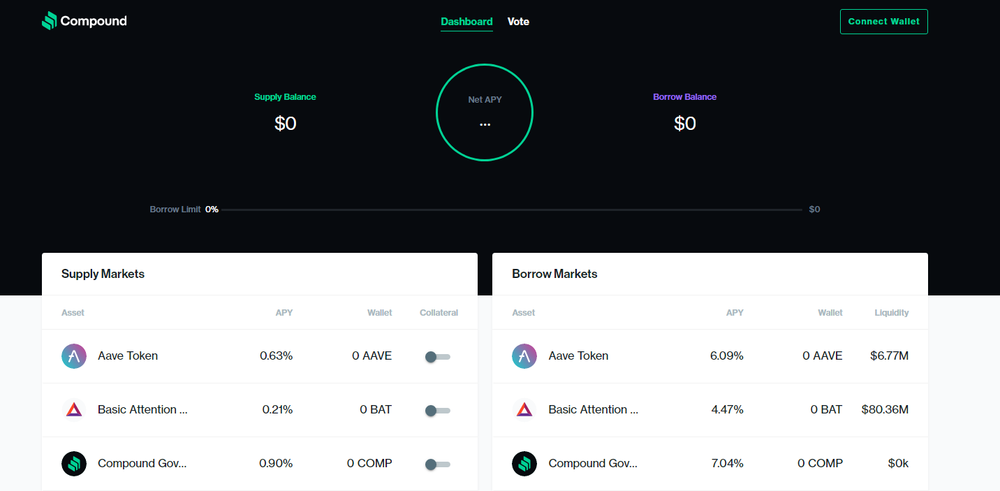

2) Compound

In the realm of cryptocurrency protocols for lending and borrowing, Compound is another well-known brand. The protocol lists many different coins, any of which you can deposit or borrow. Additionally, Compound offers a COMP token that can generate high returns when you lend your cryptocurrency to the network to provide liquidity.

You can trust the protocol with your investment as it has excellent security. Compound offers a real-time pricing feed that makes it easy to monitor platform prices based on liquidity availability. You can add money to or take money out of your account once every 24 hours.

Compound is also creating a broad array of products, services, and solutions for the DeFi (decentralized finance) ecosystem. Even more, interfaces can be connected using compound protocols.

3) MakerDAO

The cryptocurrency “Die” was created by MakerDAO. Anyone can use it anywhere and anytime. At Maker, you can deposit 25+ cryptocurrency assets as collateral as soon as you open a wallet. Once you have pledged your cryptocurrency assets as collateral, you have two choices. You can buy more collateral to increase your exposure, or you can borrow a die and hang on to it.

With Die, the maker community has effectively created an entire ecosystem of businesses and apps. You can find the right app in the ecosystem to accept, use, capture, and even receive the die. In addition, Maker Protocol offers a ton of games, the most popular of which is Sandbox.

As soon as you link Maker to your cryptocurrency wallet, you are ready to go. The site now offers cryptocurrency sales, purchases, and lending .

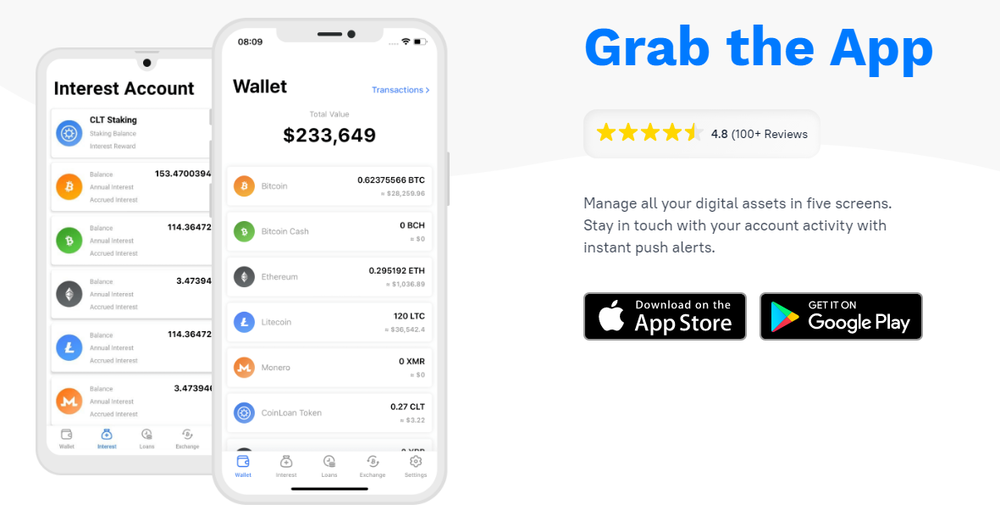

4) CoinLoan

For managing all your digital assets, CoinLoan is an extra reliable platform that works with both iOS and Android. You don’t need to worry about any costs related to deposit or withdrawal. Additionally, by simply adding your assets to the site, you can benefit from daily interest.

Your cryptocurrency holdings can be used as collateral to get a lending against cash. All accepted crypto assets are listed on the official website with their rates. Plus, you can easily buy, sell, or exchange your cryptocurrency with just a few clicks.

You can count on total asset safety when using CoinLoan. The apps offer biometric authentication for better protection of all your digital assets.

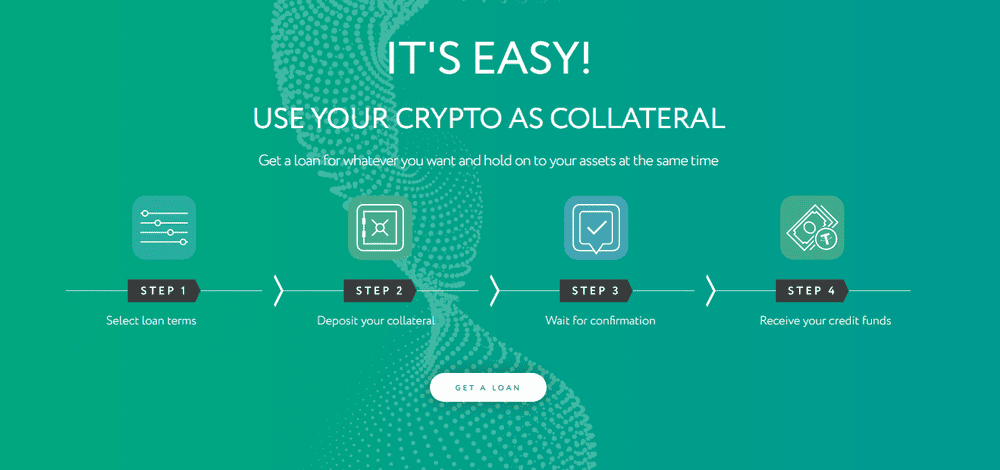

5) MoneyToken

You can easily manage all your cryptocurrency holdings on MoneyToken and apply for cryptocurrency-backed loans with a few clicks. It only takes a few clicks to complete this procedure, which is quite simple. All you have to do is wait until your application is approved and the cash is transferred to your account after choosing the loan terms and providing collateral.

You have full control over the assets that are at stake on MoneyToken, a decentralized platform. This is where you can get instant loans. If you want to lend your assets on MoneyToken, you can start by lending the platform $100 USD or any other cryptocurrency equivalent in value.

6) Binance

More than 1,400,000 transactions take place every second on Binance, the world’s top cryptocurrency exchange. In addition to being the top cryptocurrency exchange, Binance has built a proprietary ecosystem. Additionally, Binance has introduced the “BNB” coin.

Binance’s main goal is to increase the amount of decentralized finance globally. Many service providers are currently using the Binance ecosystem to build their blockchain applications.

You can think of Binance as a one-stop shop for all things blockchain. You can do it all here, including buying, selling, exchanging, trading, and even borrowing or lending your cryptocurrency assets. To get even more benefits, you can also sign up as a liquidity provider on Binance. In addition, Binance has created its own NFT Marketplace to provide a venue for NFT producers to auction their creations.

Binance is more than just a platform for loans and borrowing. Within the Binance ecosystem, any task pertaining to blockchain technology can be finished.

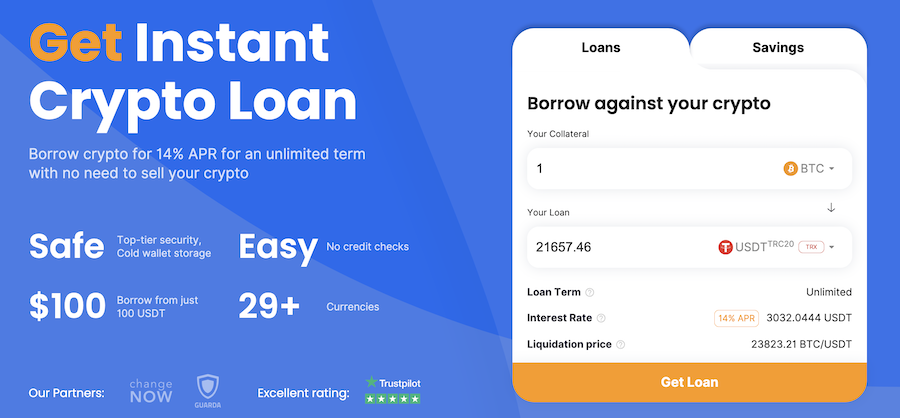

7) CoinRabbit

The quickest and easiest option for cryptocurrency loans is CoinRabbit. CoinRabbit’s user-friendly interface and non-knowledge-your-customer (KYC) approach—which simply requires your phone number or email to open an account—make it the ideal option for both novices and time-conscious specialists.

Even though CoinRabbit is easy to use, it takes customer money security very seriously. Several security and AML tests are constantly performed. The money is received and then separately withdrawn into the cold wallet mechanism. Additionally, you may always use 2FA extra protection to safeguard your account.

In addition to the low monthly APR of 1.2%, you can make entirely free withdrawals at any time and pay back your loans over an indefinite period of time, repaying them in full or in part when you feel the time is right. Additionally, CoinRabbit offers the mechanism to adjust your liquidation price as much as you’d like.

CoinRabbit streamlines and expedites the procedure for people looking to generate a respectable passive income. The highest APY available on the market is a fixed 10% rate that comes with no further requirements. You have daily access to the interest and are free to take your profit whenever you’d like.

Even though the service is still in its infancy, it is gaining speed quickly, has already made a name for itself in the community of numerous cryptocurrencies, and collaborates closely with major players in the industry like ChangeNOW, Guarda Wallet, Atomic Wallet, etc.

Visit Coinrabbit to get a crypto loan and enjoy all the perks our platform has to offer.

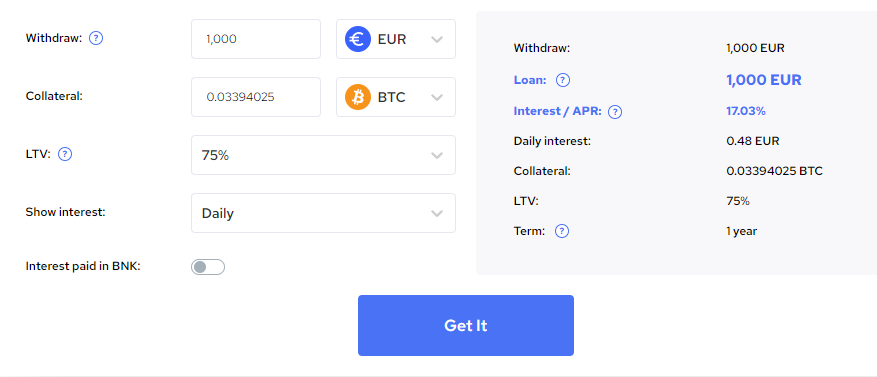

8) SpectroCoin

One of the best uses of centralized finance is the crypto loans that SpectroCoin offers, along with its many other services.

You can choose between 25% and 75% loan-to-value (LTV), depending on the coin. Collateral for SpectroCoin can be BTC, ETH, XEM, or DASH. As predicted, the highest LTV is accessible for Bitcoin and Ethereum. On the other hand, choosing a higher LTV raises your interest rates, while a larger loan amount lowers them.

Withdrawals are accepted in ETH, BTC, EUR, USDT, etc. SpectroCoin’s most beneficial feature is its wide lending range, which allows you to borrow anything from 25 EUR to $1 million.

Each loan has a maximum tenure of one year, although it can be extended at a higher rate if necessary. Monthly interest is deducted automatically, but you can repay the loan whenever it’s convenient for you and still have the agreed LTV amount in your account.

9) Nebeus

With a comprehensive ecosystem for borrowing, earning, trading, and even insuring your cryptocurrency, Nebeus is all the crypto platform you need.

They provide four distinct income plans with the best rates available in the market for renting cryptocurrency. For example, you can rent a stablecoin and get 12.85% interest per year or rent a cryptocurrency and get 6.5% interest per year. The best part is that there is not a single cost involved in paying out as often as every 24 hours or withdrawing your winnings.

What sets Nebeus apart from the competition is its expertise in cryptocurrency-backed loans. There are two options to suit every customer’s needs: Quick Loans, which carry 0% interest and are ideal for small day-to-day expenses, and Flexible Loans, adjustable up to 36-month maturity, 80% LTV. TERMS, AND PROVIDE THE OPPORTUNITY TO USE More than nine cryptocurrency coins as collateral.

Best of all, the loans are actually completely risk-free thanks to their exclusive automatic margin call management and 10-day cushion against margin calls. In order to provide you peace of mind that your money is in skilled hands, Nebeus also holds your cryptocurrency collateral in distinct cold storage accounts that are $100 million insured by Lloyd’s of London.

If you are looking for a single, reliable platform to handle all your cryptocurrency demands, Nebius is undoubtedly a great option.

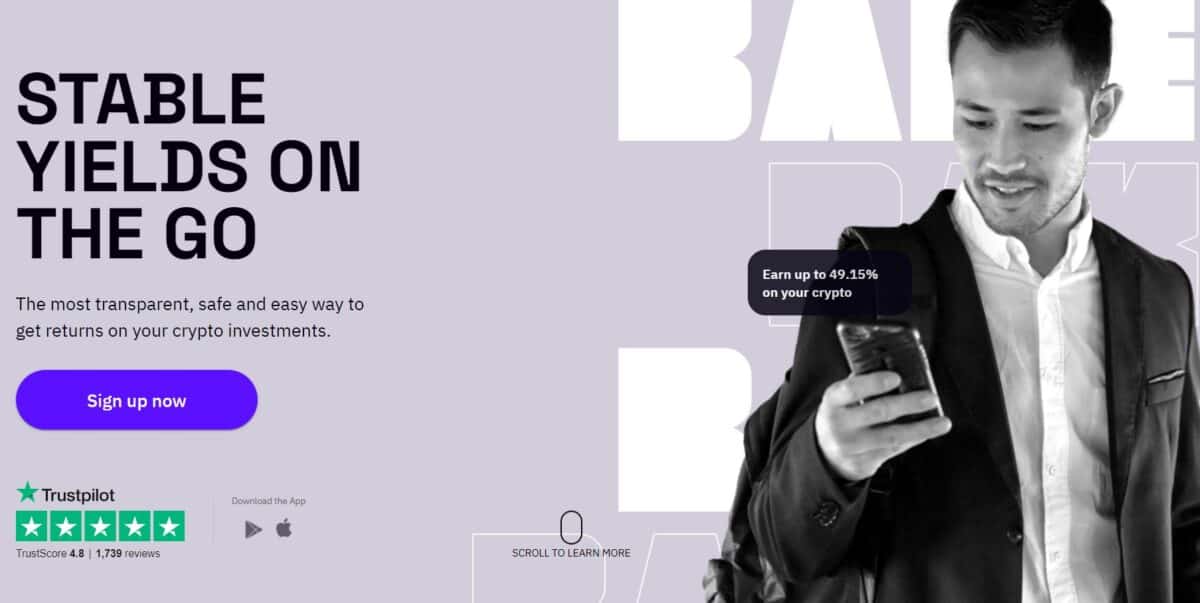

10) Bake

What about the potential bonus combined with guaranteed returns? Bake makes things easy by providing you with an accurate estimate of the minimum APY.

Currently, Back accepts loans in USDC, USDT, ETH, and BTC. With others, you can invest in batches and review past results.

After four weeks of each batch running, you can either withdraw or move to the following batch with auto-compounding.

You won’t pay anything for a payday loan. Additionally, by contacting support, you’re free to lend any amount you choose—even more than the total batch.

11) YouHodler

You can get a loan in any of the top 15 cryptocurrencies with YouHodler, offering a loan-to-value ratio (LTV) of up to 90%. YouHodler lets you store, trade, and even send cryptocurrency payments to anyone. With your Bitcoin serving as collateral, you can obtain immediate cash. Best of all, loans can be availed in USD, EUR, GBP, Tether (USDT), Bitcoin (BTC), or any other currency.

Additionally, you can get a loan for as little as $100. YouHodler’s Universal Conversion allows you to convert your assets to other formats. You can earn up to 12% interest on a variety of cryptocurrencies and stable coins by depositing your cryptocurrency with YouHodler.

An additional interesting feature is the multi-HODL function. With only a few small fees and relatively high investment returns, this effective technique will help you double your preferred cryptocurrencies.

12) Celsius

Celsius is a leading name in cryptocurrency lending and borrowing. When you lend cryptocurrency on the Celsius network, you can earn up to 17% yield. There are no costs associated with borrowing, lending, or transferring coins. The fact that Celsius is available in both web and application modes is another great feature.

Weekly payouts of up to 17% APY (Annual Percentage Yield) are expected. Regardless of the cryptocurrency you are lending, you will get great rates on the site. Additionally, if you decide to earn in CEL Tokens, you can expect to earn 25% more incentives, which are only available through the Celsys site.

You can use the calculator on the Celsius website to find out how much you can earn depending on the cryptocurrency you choose and the time period you choose. You can use your cryptocurrency as collateral to borrow from Celsius at interest rates as low as 1% APR (annual percentage rate), so there’s no need to sell it if you need emergency cash.

Abstract

If you are involved in the cryptocurrency space, you should seriously consider lending. By lending your cryptocurrency holdings to other sites, you can increase the interest rate you receive. It’s as simple as offering liquidity across multiple platforms rather than keeping them in your wallet. The best method for making passive money is this.